401k max contribution calculator

72 hrs min80 hrs max International Override Pay. Most junior captain hired.

Excel 401 K Value Estimation Youtube

Id rather see a way to calculate what percentage of income I need to save to reach the max contribution by the end of the year and not miss out on.

. ATL B717 Mar 2017. This is an increase from the limit of 19500 that was set for 2020 and 2021. Loan Term Years Months.

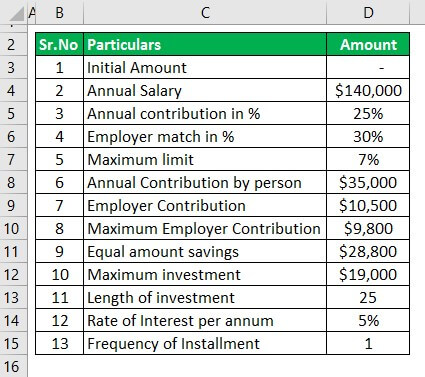

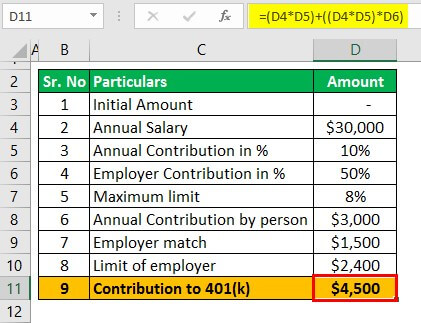

If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments. Click the Customize button above to learn more. The initial amount pertains to how much you will invest to start off with.

Yes you can max out both your 401k and 457 plan up to the maximum allowed by the IRS which is 20500 for each account. If you are in doubt about how much you can contribute as both an employee and an employer in your Solo 401k plan. Solo 401K Contribution Calculator.

This is up from 57000 and 63500 in 2020. About a fifth of 401k plans allow employees to make these kinds of contributions which are still subject to the 2021 401k plan contribution maximum of 58000 64500 for those 50 and older. How to Max Out a 401k.

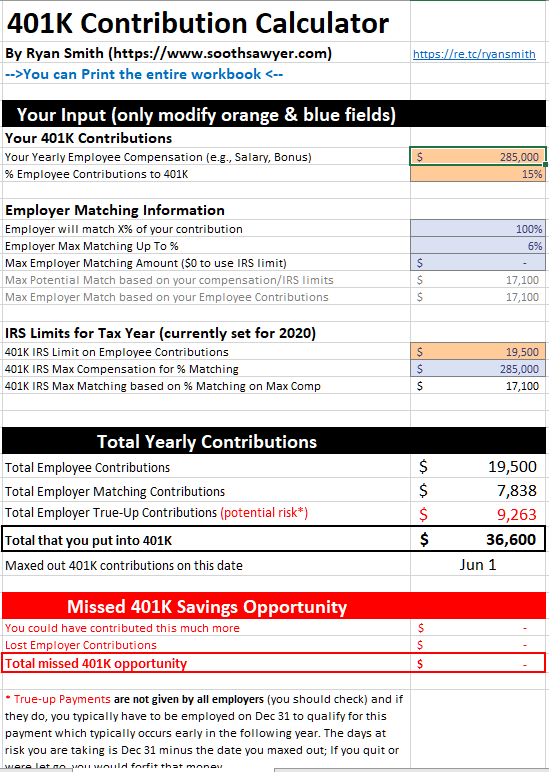

No after-tax income contribution although more power to you if you have the disposable income to do so. You can only contribute a certain amount to your 401k each year. Matching 401k contributions are the additional contributions made by employers on top of the contributions made by employees.

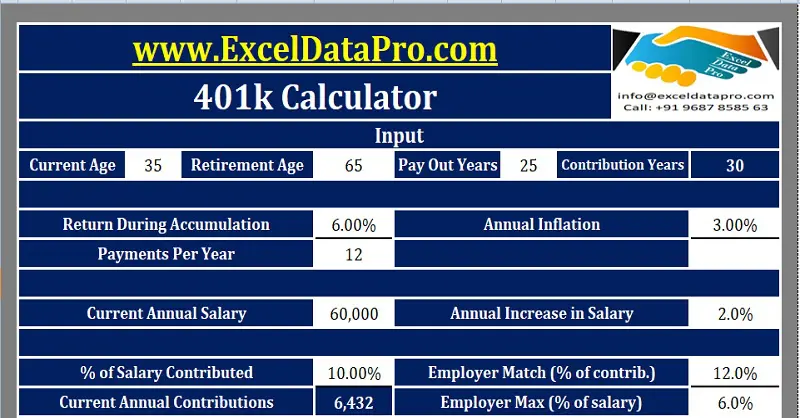

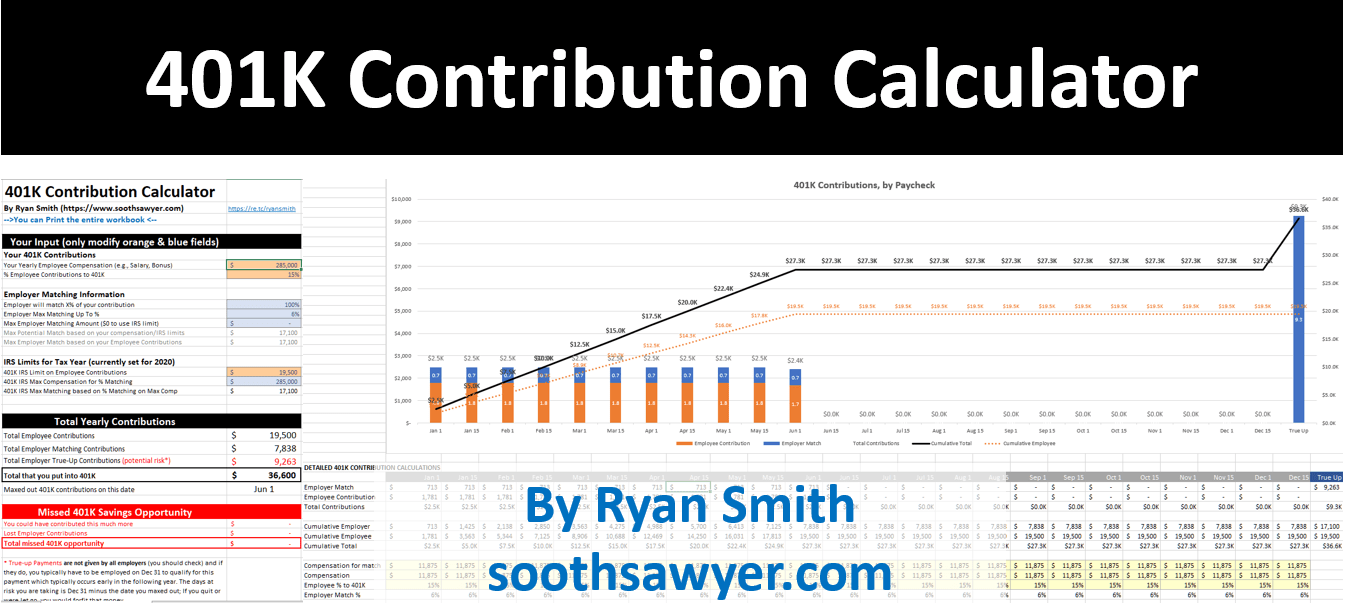

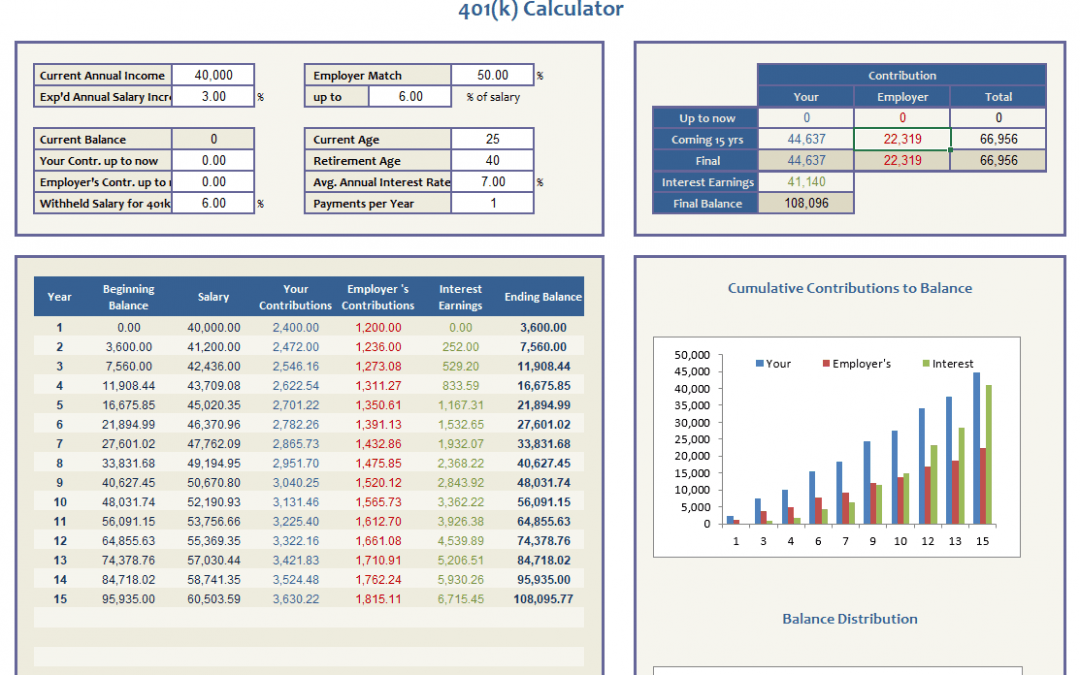

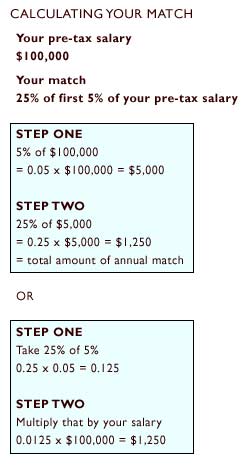

How to use 401k calculator. Company match assumption is between 0 100 of employee contribution. These matches are made on a percentage basis such as 25 50 or even 100 of the employees contribution amount up to a limit of total employee compensation.

There are two sides to your contribution. The cord calculator exactly as you see it above is 100 free for you to use. You dont want to lose out on years of compounding interest.

Google offers a 50 match on the employees contribution up to 19000 to a max of 9500 per year. Or 2 of a nonelective contribution employees may contribute but are not required to receive employer mandated contribution. Facebook offers a 50 match of 7 of your salary and bonuses up to a max of 10250 per year.

The maximum 401k contribution by an employee in 2022 is 20500. Loan Calculator Required field. 401k plans 403b plans the federal Thrift Savings Plan and most 457 pension plans.

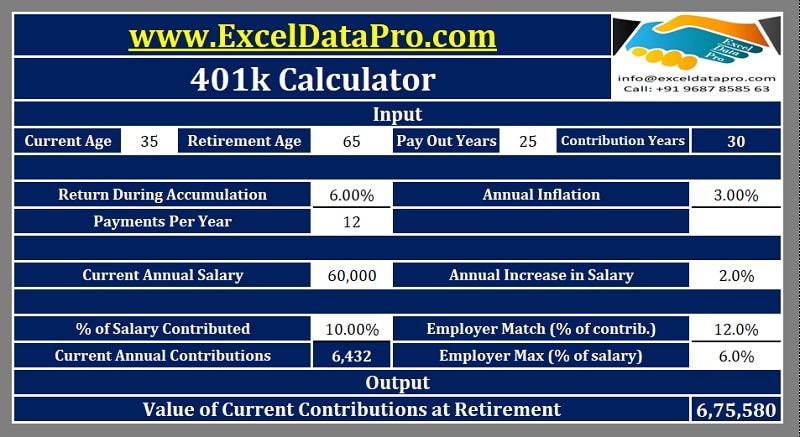

Average 401k Balance at Age 35-44 224411. The standard max 401k 2022 limit is 20500. For this spreadsheet if you enter 50 as the Employer Match and 6 as the Max Employee of Contribution this should be interpreted as 50 match up to an employee contribution of 6 This means that the company stops matching the rest of your contribution if you contribute more than 6 of your salary.

Contributing the max to both accounts results in a total tax deferral of 41000 per year not including catch-up contributions. If you havent already started to max out your 401k by this age then really start thinking about what changes you can make to get as close as possible to that 19500 per year contribution. For 2022 the contribution limit for 401k accounts is 20500 per year or 100 of your compensation whichever is less.

This calculator is fairly simple and straightforward. There are four options that can be manipulated as desired. This figure will probably be between 20 to 60 of the savings.

Then take the final answer subtract 1 and multiply. Click the Customize button above to learn more. A seamless Safe Harbor 401k for small businesses that want to make an employer contribution.

What you provide as the employee and the match from your employer if applicable. According to a Vanguard study only 12 of plan participants managed to max out their 401k in 2019. Traditional IRA vs Roth IRA.

Also for those curious my initial 401k match estimate came from searching up policies at big tech companies. 401k savings calculator helps you estimate your 401k savings at retirement based on your annual contribution and investment returns from now until retirement. This is a great way to maximize your tax advantages for those looking to quickly bulk up their retirement accounts.

Yet most people dont know how to max out a 401k. For example suppose you had gross pay of 50000 a year and got paid every two weeks. Stock Market News - Financial News - MarketWatch.

Entry Level Pilot Pay. For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level. The rate of return assumptions are between 0 10.

61000 is the total 401k contribution for. Property Tax per year. Extra Payment a Month.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. SIMPLE IRAs A Savings Incentive Match Plan for Employees allows for employers with 100 or fewer employees to contribute to a traditional IRA account of their employee and match up to 3 of total compensation.

Click the Customize button above to learn more. If you are 50 or older you can make a catchup contribution of 6500. This contribution limit applies to.

For a three-year period youd raise it to the 13 power and so on. Our most customizable 401k for business owners who want to maximize savings and receive dedicated support. Guideline Low Cost 401k Plans for Small Businesses.

Initial amount annual contribution annual interest rate and number of years. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. 650hr Capt 450hr FO.

The salary calculator exactly as you see it above is 100 free for you to use. Contribution limits to a Solo 401k are very high. For 2022 the 401k contribution limit is 20500 in salary deferrals.

Loan Amount Interest Rate per year. Below is a chart that further breaks down the 401k contribution limits for 2022 according to IRSgov. Individuals over the age of 50 can contribute an additional 6500 in catch-up contributions.

On a calculator use the power key to raise the number to the 12 power. 401k Save the Max Calculator. For 2021 the max is 58000 and 64500 if you are 50 years old or older.

A 401k for businesses that want the flexibility to pick and choose features to meet their goals. The vo2 max calculator exactly as you see it above is 100 free for you to use. PAY CALCULATOR Click and drag the sliders Pay Rate.

Download 401k Calculator Excel Template Exceldatapro

401k Employee Contribution Calculator Soothsawyer

401k Contribution Calculator Step By Step Guide With Examples

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401 K Calculator See What You Ll Have Saved Dqydj

401k Employee Contribution Calculator Soothsawyer

The Maximum 401k Contribution Limit Financial Samurai

Free 401k Calculator For Excel Calculate Your 401k Savings

Download 401k Calculator Excel Template Exceldatapro

Employer 401 K Maximum Contribution Limit 2021 38 500

Customizable 401k Calculator And Retirement Analysis Template

Retirement Services 401 K Calculator

The Maximum 401k Contribution Limit Financial Samurai

Doing The Math On Your 401 K Match Sep 29 2000

401k Contribution Calculator Step By Step Guide With Examples

Solo 401k Contribution Limits And Types

The Maximum 401 K Contribution Limit For 2021